Social Security Benefits to Increase by 2.5% in 2025: What You Need to Know

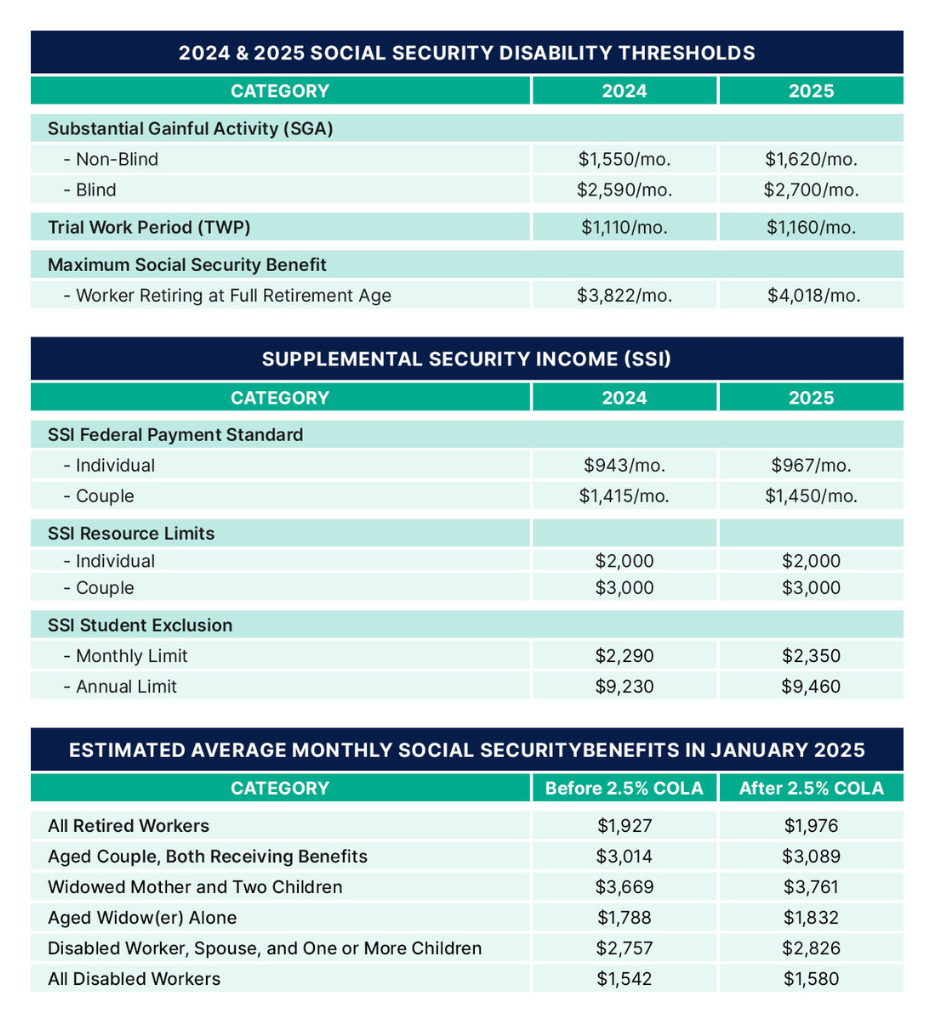

The Social Security Administration announced Friday, October 11, 2024, that the Social Security and Supplemental Security Income or SSI payments will increase in 2025 by 2.5%. The adjustment, called the cost-of-living adjustment or COLA, will affect more than 72.5 million Americans and help them keep up with rising living costs.

The 2.5% increase comes out to an average hike of about $50 per month for Social Security retirement beneficiaries. The COLA increase will take effect on December 31, 2024, for SSI recipients, while Social Security beneficiaries will see it reflected in their payments starting January 2025.

What is COLA?

“Cost-of-Living Adjustment” (COLA) refers to the yearly increase in Social Security and SSI benefits to keep their purchasing power in the face of inflation. The SSA applies the CPI-W for measuring COLA. The CPI-W looks at how the cost of goods and services changes over time to know whether consumer prices rise or reduce in growth to determine the cost-of-living adjustments.

When Will the COLA Increase Take Effect?

- Social Security Benefits: The 2.5% COLA will take effect starting in January 2025.

- SSI Payments: The adjustment will be applied beginning December 31, 2024.

How Much Will My Benefits Increase?

While the average Social Security retirement benefit will increase by approximately $50 per month, the actual amount of your increase will depend on your current benefit level. For example, a retired worker currently receiving $1,927 monthly will see an increase to about $1,976 after the COLA is applied.

Other Changes for 2025

In addition to the COLA, the SSA announced an increase in the maximum taxable earnings for Social Security. For 2025, the taxable maximum will rise from $168,600 in 2024 to $176,100. This change means higher earners will contribute more to Social Security through payroll taxes.

How to Access Your COLA Notice

The SSA will mail COLA notices to Social Security beneficiaries starting in early December 2024. For the first time, the notice will be a simplified, one-page document that clearly outlines your new benefit amounts, deductions, and key dates.

Medicare Beneficiaries

If you are a Medicare beneficiary, you can expect to receive additional details about changes for 2025 in late November through the my Social Security Message Center. Updates regarding Medicare will also be available on www.medicare.gov.

Understanding Disability Benefits

For those receiving disability benefits, it’s essential to understand how the 2025 COLA and other adjustments may affect your payments. At Trajector Disability, we specialize in helping individuals navigate the disability claims process and maximize their benefits. Our team ensures you receive the full amount of benefits you’re entitled to under the new COLA regulations.

Contact Us for a Free Consultation

At Trajector Disability, our team of experts is ready to help you understand your possible benefits and lead you through your journey! Whether you’re seeking Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), our experts are ready to assist you. Schedule a free consultation, and rest assured—you won’t be charged unless your claim is approved.

FAQ

What is the average Social Security benefit amount in 2025?

The average Social Security retirement benefit in 2025 is expected to be around $1,976 per month.

When will I receive my first COLA increase payment?

If you are eligible for Social Security benefits, your first COLA-increased payment will arrive in January 2025.

How is the COLA calculated?

The Cost of Living Adjustment (COLA) is determined by the changes in the cost of living, which are measured using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the previous year to the third quarter of the current year.

Will my SSI payments also increase in 2025?

Yes, SSI payments will increase by 2.5% starting December 31, 2024.

What is the maximum taxable earnings for Social Security in 2025?

The maximum taxable earnings for Social Security in 2025 is $176,100.